1 KEEI Research Report 17-15

Study on the Establishment of a Rational Support System for Private Sector Resource Development

Taeeui Lee

2

Research Staff

Head Researcher: Vice Research Fellow Taeeui Lee Research Associates: Postdoctoral Researcher Simgun Choi

Associate Professor Jinkwon Lee of Sogang University

3 ABSTRACT

1. Background and Research Objective

Due to the recent decline in oil prices and the deterioration of financial conditions of state-owned enterprises, public investment in upstream sector has ceased along with private investment. Unlike the government announced that it will stimulate private investment for oil and gas upstream, the resource development policy is not clearly and consistently presented. In 2017, a loan of 100 billion won was allocated under the new name of Special Loan.

However, in case of failure, the lender still needs to pay 30% of the loan where it was fully exempted before. With the reduction of loan support, the tax exemption for E&P business is also abolished. As a result, the burden of investment decisions on E&P business, which poses a high risk to private companies, is increasing.

It is necessary to establish a reasonable support system for upstream investment in Korea in order to promote private oriented investment which has weakened recently. Therefore, this study analyzes the overseas resource development policy of Korea, summarizes the objectives to be considered by the resource development policy in the future, and suggests the establishment direction of the support system according to the goal.

2. Summary and Policy Implications

The government has newly launched the special loan to solve the problem of moral hazard issue that could arise from the contingent loan for upstream investment. Generally, in the case of equity investments, which does not have operating rights, the level of the company's effort is hard to be influenced by the contingent loan, because company's investment precedes the application for the loan. That is because the application for contingent loan require invoice of the investment. Thus, this study shows that the analysis of the contingent loan through the simulation for the operating rights business. The special loan is not a right direction to enhance the company's effort level, but it brings the distortion that cannot reach the optimal solution. In addition, the improvement of the financing system through special loans has revealed the possibility of being adjusted in a way that induces the departure of participating companies rather than solving the social issue of moral harmony. As a result, under the assumption that moral hazard exists, the preferred direction of adjustment for special loans is to consider not only reducing the reduction rate and the loan rate but also lowering the special contribution, It is possible to increase the level of enterprise effort.

In order to establish a reasonable support system for private investment in resource development in Korea, it is necessary to understand what support is needed. It is possible to summarize the purpose of government resource

4

development necessary for the establishment of various types of support policies discussed so far. First, it is the purpose of security to secure supply and demand stability in an emergency. Resource development by the public sector can be more rational if resources are developed for security purposes. This is because the incentive on the private sector for the purpose of security such as establishing emergency import system is small, and the operation through state-owned enterprises is more efficient. In this way, if the E&P project is led by the state-owned enterprises, equity investment and debt from government can be effective. The second is economic stabilization through price hedging of resource prices. In order for price hedging to be meaningful, it is necessary to expand the scale of resource development. It is possible to accomplish this goal by participating in resource development projects or acquiring stakes in companies that consume resources together with the resource development projects of public enterprises. Since the stabilization of the economy can be achieved even if the private sector does not have a right to operate the upstream project, it can be achieved by attracting private sector for equity investment if the government support to improve the internal rate of return through the loan and tax reduction. Finally, it is the fostering of E&P industry that can accompany new domestic industry. While economic stabilization could only be achieved through equity investment in the resource development business, it is necessary to participate in the operation right business to foster the industry. Therefore, in order to nurture industry, it is necessary to provide support system that can give incentives for companies to participate in operating rights business through taxation system such as overseas resource development facility investment tax credit, Japan's loss reserves and exploration reserves tax exemption.

The purpose of overseas resource development policy is not limited to securing energy security, mitigating the impact of economic shocks, and nurturing E&P. Conducting resource development for economic stabilization can have a positive impact on resource security. As E&P industry and related industries grow, economic stabilization and security objectives can be achieved naturally.

However, not only the establishment of policy goals and institutions, but also the way in which they are operated needs to be considered. It is how consistently the system is operated. The contingent loan to support private investment has not been operated consistently, and the improved special loan has been poorly engaged. In order to encourage reasonable global E&P investment, establishment of clear and consistent policy objectives should be a prerequisite.

5

Table of Contents

Chapter 1. Introduction ···10

Chapter 2. Overseas Resource Development Support System ···12

1. Resource development support policy of the United States ···12

A. Financial support system ···12

B. Tax support system ···16

2. Resource development support policy of Japan ···20

A. Financial support system ···22

B. Investment guarantees ···26

C. Policy finance provided by other supporting organizations ···28

D. Tax support system ···31

Chapter 3. Domestic Resource Development Support System ···35

A. General loan and Special Loan systems ···35

B. Insurance/guarantee system ···39

C. Tax support system ··· 42

Chapter 4. Problems with the Domestic Resource Development Support System:Moral Hazard of the Success Repayable Loan···47

1. Prior research on the Success Repayable Loan ···47

2. Analysis of exploration projects using the Contract Theory approach ···48

A. Where there is information symmetry between investors (government) and an exploration company ···48

3. Theoretical study on the Success Repayable Loan ···55

A. Success Repayable Loan under information symmetry ···55

B. Success Repayable Loan under information asymmetry ···63

6

4. Analysis of the Special Loan (an improved loan system) ···80

A. Benchmark: Success Repayable Loan system ···81

B. Case where the loan ratio is lower (Special Loan) ···81

C. Case where the loan ratio is fixed ···82

D. Analysis results···82

Chapter 5. Reasonable Support System for Private Resource Development ···84

1. Improvement plan for the resource development support system ···84

A. Improvement of loan system ··· 84

B. Re-introduction of special tax treatment ··· 84

C. Policy consistency ··· 86

2. Establishment of support system for realizing the goals of government resource development support ··· 89

Chapter 6. Conclusion ··· 93

References ··· 96

7 List of Tables

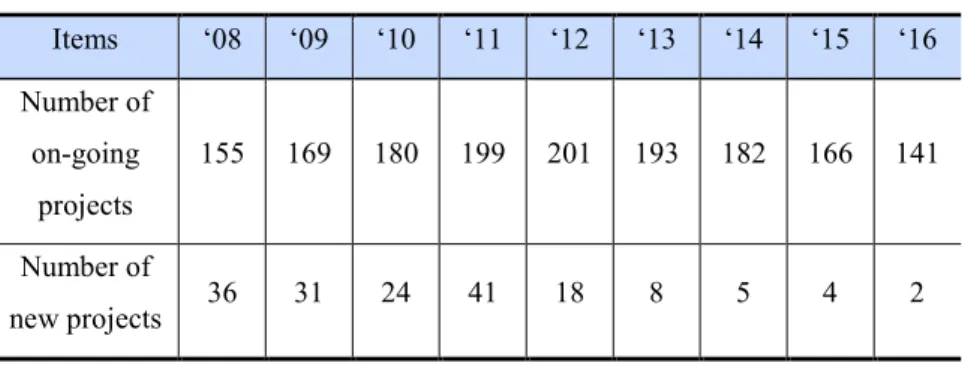

Table 1-1. Participation by year ··· 10

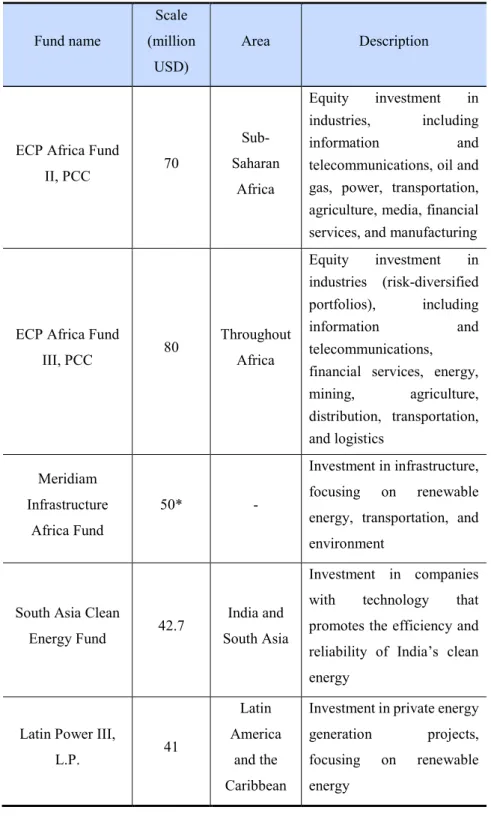

Table 2-1. OPIC-supported private investment funds ··· 15

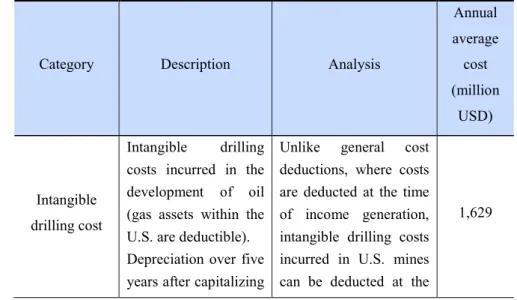

Table 2-2. Major tax benefits for U.S. petroleum and natural gas developers··· 18

Table 2-3. Changes in financing system for exploration projects ··· 22

Table 2-4. Business areas eligible for JOGMEC’s equity investment and corresponding ratios ··· 23

Table 2-5. JOGMEC’s stake of total ownership for private sector investment of 25% of total capital ··· 24

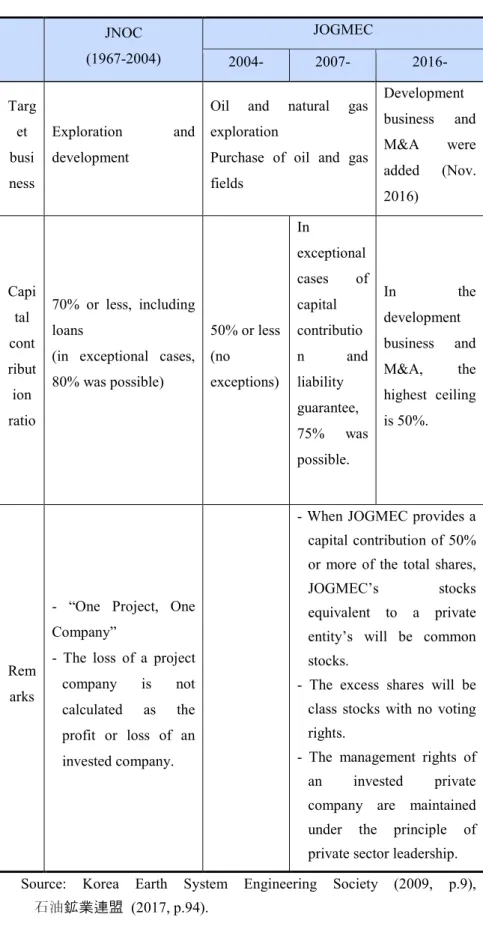

Table 2-6. Changes in businesses eligible for capital contribution and the capital contribution ratio in Japan ··· 25

Table 2-7. Changes in the liability guarantee system ··· 27

Table 2-8. Amount of JBIC development loans for oil exploration and development projects ··· 29

Table 2-9. Types of insurances and businesses eligible for coverage provided by Nippon Export and Investment Insurance ··· 30

Table 2-10. Japan’s tax benefits for oil and natural gas development ··· 33

Table 3-1. Petroleum development loan amount and cumulative loan recovery ··· 36

Table 3-2. Comparison of the Success Repayable Loan and Special Loan ··· 38

Table 3-3. Overseas resource development funds covered by insurances ··· 40

Table 3-4. Tax support system for overseas resource development ··· 42

Table 3-5. Tax exemption and reduction amounts ··· 45

Table 4-1. Form of optimal contract ··· 55

Table 4-2. ··· 74

Table 4-3. ··· 74

Table 4-4. ··· 75

Table 4-5. ··· 76

Table 4-6. ··· 79

Table 4-7. ··· 79

8

Table 4-8. ··· 79 Table 5-1. Major policy changes in basic plans for overseas resource development ··· 87 Table 5-2. Changes in management evaluation items of Korea Oil Corporation ··· 88 Table 5-3. Establishment of a support system corresponding to the goal of resource development support ··

··· 92

9 List of Figures

Figure 2-1. Japan’s resource development support system ··· 21

Figure 2-2. JOGMEC’s accumulated investment and number of sponsored companies ··· 26

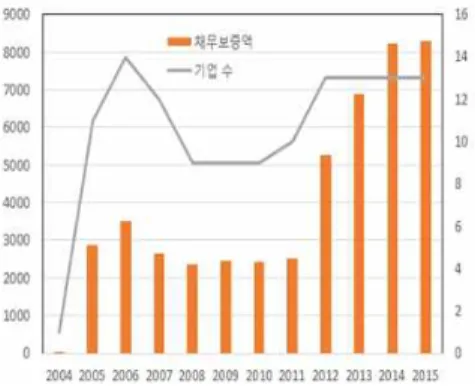

Figure 2-3. JOGMEC’s liability guarantee amount and number of sponsored companies ··· 27

Figure 3-1. Changes in loan ratios of overseas resource development loans (after Asian financial crisis) 36 Figure 4-1. Risk-neutral company (information symmetry)··· 60

Figure 4-2. Risk-averse company (information symmetry) ··· 61

Figure 4-3. Risk-neutral (adverse selection) ··· 66

Figure 4-4. Risk-averse (information symmetry)··· 67

Figure 4-5. Company’s expected cost and its decision to participate in projects ··· 80

Figure 5-1. Problems with the operation of Korean businesses identified through the Global Competitiveness Report··· 86

Figure 5-2. Forecast of world energy demand ··· 90

10

Chapter 1. Introduction

As Korea relies on imports for most of its energy resources, resolving resource security issues through the acquisition of resources is a long-term and ongoing challenge. As a means of overcoming unexpected energy supply and demand crises, stockpiling has been carried out since the 2000s, along with the promotion of overseas resource development, in order to build a stable energy supply system. In 2014, the debt-to-equity ratio of state- owned resource enterprises (or public corporations) increased as oil prices declined, leading to growing concerns over financial soundness and corporate governance. In addition, due to the problem of the moral hazard inherent in the Success Repayable Loan,1 which was one of Korea’s major support systems for overseas resource development, the negative perception of E&P (exploration & production) businesses spread, and the support system could not be operated properly. It is clear that private investment plays an important role in fostering the E&P industry in the face of the financial unsoundness and corporate governance of public corporations. However, due to the decline in oil prices, both public corporations and private-sector companies have been reining in their participation in resource development.

Table 1-1. Participation by year

(as of December 2016) Items ‘08 ‘09 ‘10 ‘11 ‘12 ‘13 ‘14 ‘15 ‘16 Number of

on-going projects

155 169 180 199 201 193 182 166 141

Number of

new projects 36 31 24 41 18 8 5 4 2

Source: internal data of the Ministry of Industry

As a result, as investment in resource development has been declining, financial and tax support, which has been implemented to stimulate investment in overseas resource development, has also decreased. The Success

1 As one of the loan schemes for resource development, the Success Repayable Loan was a loan system with conditional redemption that exempted the repayment of the principal in the case of project failure and required the debtor to pay a special charge in addition to the principal in the case of project success. The specific characteristics of the system are described in Chapter 3 (Domestic Resource Development Support System).

11

Repayable Loan, which had been the largest source of support for the development of overseas resources in the private sector, has not been offered since 2016. In 2017, a new loan of KRW 100 billion was allocated under the new name “Special Loan.” However, in the case of project failure, the debtor now has to repay 30% of the loan, whereas it was fully exempted before. The transition to the new loan was done in an effort to reduce its role in risk-sharing. With the reduction of direct financial support, the system of tax incentives is also being abolished as the sunset clauses expire. As a result, the burden of decisions on investment in resource development, which is a high-risk business for private companies, is increasing.

Contrary to the government’s announcement that it will carry out civilian-centered resource development, the private support system has been reduced, and the government’s resource development goals and operation of the resource development support system have been inconsistent, causing confusion among private investors. Despite the turmoil in the resource development industry, the new government’s top 100 projects do not include any resource development plans, showing that the government has no clear goal for resource development.

It is necessary to establish a reasonable support system for the overseas resource development activities of Korean companies in order to promote private sector-led resource development investment, which has weakened recently. Therefore, this study analyzes and examines Korea’s overseas resource development policy, summarizes the objectives that the policy should pursue in the future, and suggests a direction for the establishment of a support system in accordance with said objectives.

The composition of this study is as follows. Chapter 2 analyzes the resource development support systems of the United States, which is where most of the private operators involved in oil and gas upstream industries are located, and Japan, which has a system similar to that of Korea. Next, Chapter 3 analyzes Korea’s resource development support system. Chapter 4 presents a theoretical examination of the moral hazard of the Success Repayable Loan, which provided the greatest support for resource development in Korea, and suggests the impacts that the improvement plan for the Special Loan, which was introduced to solve the problems with the Success Repayable Loan, is actually having on resource development investors. Chapter 5 outlines the improvement plan for Korea’s resource development support system and provides a direction for the establishment of a support system that meets the country’s resource development policy goals. Finally, the conclusion presents a summary of this study and its implications.

12

Chapter 2. Overseas Resource Development Support System

This chapter introduces the resource development support systems of the United States and Japan as representative examples of such systems. The United States is the country with the most advanced resource development industry in the world, from a capitalist standpoint, and Japan, which has the same level of self- sufficiency in terms of natural resources as Korea, is especially focused on overseas resource development as well. Therefore, before analyzing Korea’s support system, we will first take a look at the resource development support systems of the United States and Japan.

1. Resource development support policy of the United States

A. Financial support system

1) Export-Import Bank of the United States (EXIM)2

The oil and gas industry is viewed by EXIM as one of the country’s most important industries. It is a major industry with a scale substantial enough to play a large role in creating jobs in the United States. More than 10,000 companies, ranging from small to large, supply petroleum-related goods and services inside and outside the United States, including in the areas of exploration, drilling, and refining. Although U.S. companies in the petroleum industry are technological leaders in their field, competition with new companies in Western Europe, Canada, Asia, and South America is intensifying. The petroleum industry (including oil and gas exploration, oil and gas field development, pipelines and distribution, oil refining, and petrochemicals) has long occupied a large proportion of EXIM’s portfolio. From fiscal year 2001 to 2016, EXIM provided USD 148 billion for 78 projects or transactions, including 49 projects in Latin America, 14 in Africa, 6 in Russia/former Soviet Republics, 5 in the Middle East, and 4 in Asia. In fiscal year 2010, EXIM provided approximately KRW 3 billion for an LNG project in Papua New Guinea, which included natural gas liquefaction facilities, pipelines, and gas field development. The purpose of the project was to export gas to Asia, which has been making significant contributions to the economy of Papua New Guinea. EXIM plays a role in helping U.S. oil companies, which are dominant in the global market (investing more than USD 200 billion in overseas resource development annually), increase their competitive edge against their foreign competitors.

2 https://www.exim.gov/learning-resources/key-industries, visited on September 8, 2017.

13

EXIM also supports the U.S. mineral industry, which is a major supplier of minerals in the coal, copper, gold, and uranium markets. The United States is thus expected to continue playing a major role in open-pit and underground mine projects. Equipment produced in the United States, based on the country’s high levels of innovation and technology, enables U.S. mining equipment exporters to maintain their competitiveness in the global market, and EXIM will continue supporting these exporters. EXIM has played an influential role in mining and mineral processing projects since its establishment in 1934. Since first providing support in Latin America, it has gone on to support projects in Canada, Argentina, Russia, Africa, and Australia. In fiscal year 2010, EXIM provided USD 900 million for the following mineral projects:

• Sangatta open-pit coal mine in Indonesia (USD 18 million)

• Boleo underground copper and cobalt mine in Mexico (USD 420 million)

• Barrick’s Pueblo Viejo open-pit gold mine in the Dominican Republic (USD 375 million)

• Ferroexpo iron ore mine in Ukraine (USD 20 million)

• Open-pit iron ore mine in Canada (USD 62 million)

EXIM also supports small-scale exporters that sell gravel, limestone, and sand. As in other industries, EXIM assesses the potential of mineral projects and their environmental and social impacts and supports projects that are consistent with its guidelines. Over the past several decades, EXIM has helped U.S. mineral exporters maintain their competitive edge in mineral market, allowing them to then contribute to the creation of jobs throughout the United States. Currently, EXIM receives a variety of project proposals from all around the world.

2) Overseas Private Investment Corporation (OPIC)3

OPIC provides loan, guarantee, political risk insurance, and investment fund support services to help U.S.

companies expand into emerging markets. It mobilizes private capital, promotes U.S. foreign policy in order to solve difficulties faced by development projects, and expands opportunities for profits, jobs, and growth both at home and abroad. OPIC’s support vehicles are debt financing, insurance, and funds, the details of which are outlined below.

First, OPIC provides mid- to long-term debt financing, such as direct loans and guarantees, for investments made by U.S. companies in developing and emerging countries, thereby supporting such companies in carrying out their projects in emerging markets. By complementing the private sector, OPIC can provide financing in countries where conventional financial institutions are often reluctant or unable to lend. It can also satisfy the

3 ttps://www.opic.gov/what-we-offer/overview, visited on October 11, 2017.

14

long-term capital investment financing needs of companies of any size in a wide variety of industries, such as information technology, health care, education, infrastructure, telecommunications, financial services, housing, and agribusiness. The majority of OPIC’s financing is used to cover the capital costs (such as design/engineering services, facility construction or leasehold improvements, and equipment) associated with the establishment or expansion of foreign investment. OPIC can also work with financial institutions to fund the expansion of lending capacity in a foreign market. Although OPIC does not provide financing solely for the purpose of making acquisitions, a certain portion of acquisition costs may be financeable if additional capital will be expended to expand investment. Depending on the project type and ability to repay the debt, the contract period usually varies between 5 and 20 years, sometimes spanning up to 30 years. Considering the time it takes to complete a project, a grace period for principal repayment is generally granted at the beginning of the contract, depending on the circumstances of the project. Loans range from USD 500,000 to USD 250 million, with the average falling between USD 5 million and USD 50 million.

OPIC also provides political risk insurance services for projects in areas where political risks exist. Emerging markets may present risks of politically motivated violence (war, social conflict, terrorism, etc.), expropriation (breach of contract, refusal of payment, violation, etc.), and political problems (improper host government interference, restrictions on the transfer of revenue, etc.). OPIC’s political risk insurance provides guarantees for losses of tangible assets, investment value, and income due to such political risks. By mitigating their business risks, OPIC allows U.S. businesses to leverage emerging-market opportunities and compete in the global market.

Political risk insurance is available to U.S. investors, lenders, contractors, exporters, and NGOs for investments in more than 160 developing and post-conflict countries. Stock-related guarantees can be provided for periods of up to 20 years. In the case of loans, leases or sales by contractors, or insurance products for exporters, the terms are the same as the terms of the underlying contracts or separately agreed-upon terms. OPIC guarantees up to 90%

of eligible investments, and OPIC’s rules and regulations require investors to assume responsibility for a minimum of 10% of their investment losses. However, in the case of loans or capital leases provided by a third-party financial institution, 100% of the principal and interest is guaranteed.

Finally, OPIC provides support for the creation of private equity funds, in response to the shortfall of private equity capital in developing countries, which has made it one of the largest private equity fund sponsors in developing nations. These funds generate direct equity and equity-related investments in new, expanding, and privatizing emerging-market companies. OPIC-supported funds help people in low-income and developing countries create new opportunities and expand economic development by providing long-term growth capital, management skills, and financial expertise. Since 1987, OPIC has committed USD 41 billion to 62 private equity

15

funds in emerging markets. In turn, these funds have invested USD 56 billion in more than 570 privately owned companies across 65 countries. Through these commitments, OPIC catalyzes U.S. foreign direct investment and accelerates economic and social development within these markets. Among the funds currently supported by OPIC, the following are related to the energy business.

Table 2-1. OPIC-supported private investment funds

Fund name

Scale (million

USD)

Area Description

ECP Africa Fund

II, PCC 70

Sub- Saharan

Africa

Equity investment in industries, including

information and

telecommunications, oil and gas, power, transportation, agriculture, media, financial services, and manufacturing

ECP Africa Fund

III, PCC 80 Throughout

Africa

Equity investment in industries (risk-diversified portfolios), including

information and

telecommunications, financial services, energy, mining, agriculture, distribution, transportation, and logistics

Meridiam Infrastructure

Africa Fund

50* -

Investment in infrastructure, focusing on renewable energy, transportation, and environment

South Asia Clean

Energy Fund 42.7 India and South Asia

Investment in companies with technology that promotes the efficiency and reliability of India’s clean energy

Latin Power III,

L.P. 41

Latin America

and the Caribbean

Investment in private energy generation projects, focusing on renewable energy

16 Sea region

* Up to USD 50 million

Source: OPIC (2017), pp.1-3, p.5.

B. Tax support system

1) Deduction of intangible drilling costs

Intangible drilling costs are the costs involved in the drilling process that generate no physical value, including the costs of borrowing drilling equipment and paying wages. These costs have no salvage value and generally account for 65% to 90% of the total drilling cost.4 Intangible drilling costs are usually amortized over a period of five years. However, with the tax benefit of deducting intangible drilling costs, independent producers in the United States can deduct 100% of their intangible drilling costs in the same year the costs are incurred. On the other hand, major companies with integrated upstream and downstream investments are eligible to deduct up to 70% of their intangible drilling costs in the year of cost incurrence, with the other 30% being capitalized in the year of cost incurrence and amortized over the following five years.

Typical deductions are executed by deducting the expenses incurred from income based on recognized revenue.

However, drilling is unlikely to be directly linked to production and revenue, due to its high probability of failure.

Therefore, drilling costs are deducted at the time of cost incurrence, even when the drilling fails to result in revenue, in order to enable continued investment in drilling. The deduction system is designed to be relatively favorable for independent companies. This is because the deduction system helps revitalize industries in the United States by giving tax advantages to independent companies focused on developing oil fields in the country rather than overseas, where major companies tend to concentrate their efforts.

The deduction of intangible drilling costs, which has been maintained for more than 100 years since 1913, was reformed to establish the current system in 1986,5 with an annual average deduction of USD 1.629 billion.6

2) Percentage depletion

4 http://www.ipaa.org/taxes, visited on October 23, 2017.

5 Energy Tax Facts (2013, p.1).

6 G20 (2015, p.30).

17

Oil and gas assets lose their value as production from a defined reserve proceeds. For tangible assets, depreciation costs incurred due to the passage of time can be deducted from taxable income. Based on the same concept, the residual value of resource assets (such as petroleum, gas, and minerals) falls as the reserve decreases during the course of oil and gas production. Percentage depletion is applied to deduct a decreased value. Cost depletion is a method of deducting the value of actual production, while percentage depletion is a method of deducting a certain percentage of the total revenue.

It is also a tax benefit that has been applied to the income tax deduction for over 100 years since 1913.7 As a deduction for small independent companies or royalty owners, this system allows independent companies and royalty owners (with an average production of 1,000 boe/d of oil or 6,000 mcf/d of natural gas) to be eligible for a percentage depletion deduction of up to 15% of their gross income.8 The percentage depletion deductible amount cannot exceed 65% of the total net profit or 100% of the net income from each oil and gas well.9

The percentage depletion deduction is determined based on total revenue, so a company using the system does not have to consider the costs associated with deductions. In addition, if income is generated continuously, there is no limit on the percentage depletion deduction amount. Therefore, the accumulated amount of the percentage depletion deduction may exceed the cost of acquiring an oil and gas field. This deduction is also an advantage for independent companies because major companies are not eligible for it.

An annual average of USD 966 million has been deducted in the United States, and the deduction system is the second-largest tax benefit after the intangible drilling cost deduction benefit.

3) Geological and geophysical (G&G) expenditure amortization

Independent companies in the United States can amortize geological and geophysical (G&G) expenditure incurred during oil and gas exploration over two years. Major companies are permitted to amortize their G&G expenditure over seven years. G&G expenditure amortization has been in effect since 1913, but the current two- year amortization period was introduced in 2005, and the seven-year amortization period for major companies

7 Energy Tax Facts (2013, p.1).

8 http://energytaxfacts.com/issues/percentage-depletion, viewed on October 23, 2017.

9 Ibid.

18

was introduced in 2007.10 The tax benefits expedite exploration activities in the petroleum and natural gas industry by allowing for the prompt deduction of costs. This is because, even if the outcomes of exploration are not directly related to production and profit, the exploration costs can be deducted. It is known that an annual average of USD 288 million is deducted in the United States.

4) Passive loss exception rules

Passive activity is an investment activity in which an investor is not “materially” involved, only his or her funds are invested. Passive asset losses are losses arising from such passive activity. In general, passive losses can only be deducted from passive income. However, passive loss exceptions allow investors to deduct their passive losses against their active asset gains arising from working interests in oil and gas production activities as if they were materiality involved in actual business activities. This system is intended to attract private investors from the market to the oil and gas industry by offering such exceptions to capital investors. An annual average of USD 19 million has been deducted since the tax benefit act passed Congress in 1986. It also facilitates private capital input to venture companies involved in oil and gas production in the United States so as to sustain their resource development activities. Indeed, the market share of small businesses in the United States is quite large, with small- scale operators producing less than 15 barrels a day, accounting for 19% of total domestic oil production.11

Table 2-2. Major tax benefits for U.S. petroleum and natural gas developers

Category Description Analysis

Annual average cost (million

USD)

Intangible drilling cost

Intangible drilling costs incurred in the development of oil (gas assets within the U.S. are deductible).

Depreciation over five years after capitalizing

Unlike general cost deductions, where costs are deducted at the time of income generation, intangible drilling costs incurred in U.S. mines can be deducted at the

1,629

10 Energy Tax Facts (2013, p.2).

11 http://energytaxfacts.com/issues/percentage-depletion, visited on October 23, 2017.

19 30% of intangible drilling costs is allowed, with the remaining 70% being deductible from gross income.

time of cost incurrence.

This is allowed in consideration of the risk of generating no revenue due to drilling failure.

Percentage depletion

For independent companies and royalty owners with an average production of 1,000 boe/d or less, percentage depletion can be applied for deductions of up to 15% of total revenue from their oil and natural gas assets. The deductable amount for percentage depletion cannot exceed 65% of total taxable income or taxable income from petroleum gas assets.

Cost depletion method:

percentage of the depreciation for an actual production amount.

Percentage depletion method: applied to portion of total revenue in consideration of the risk of producing less oil and gas than expected due to drilling failure.

966

Geological and geophysical

(G&G) expenditure

Independent

companies amortize their G&G expenditures for oil and gas exploration in the United States over two years.

Major companies amortize their G&G expenditure over seven years.

Facilitates oil and gas exploration activities through tax benefits by raising the amortization rate.

288

Passive loss exception

Asset loss is treated as active loss, thereby enabling investors to deduct their losses as if they were actively operating their own businesses.

To attract capital investment to the petroleum and natural gas industry, an accounting exemption rule is set up to allow the capital loss of investors

19

20

to be treated as an operating loss.

Domestic manufacturing

deduction

As a means of revitalizing domestic manufacturing, up to 9% of income from qualified production activities is deductible.

However, the

deductible amount cannot exceed 50% of wage expenditure.

The oil and natural gas industry is allowed to apply a rate of up to 6%

The domestic

manufacturing deduction is applied to not only the oil and natural gas industry but all domestic industries as well.

1,049

Source: G20 (2016, pp.16-23), summarized by the author.

2. Resource development support policy of Japan

In 1978, Japan established the Japan National Oil Corporation (JNOC), similar to the Korea Oil Corporation, and tasked it with stockpiling oil and supporting oil development companies. Until its abolishment in 2004, the JNOC provided financing, investment, and liability guarantees for oil exploration. In 2004, the Japan Oil, Gas and Metals National Corporation (JOGMEC), an independent administrative agency, was established, taking on the role of the former JNOC. As can be seen in Figure 2-1, JOGMEC conducts overseas geological structure surveys in order to secure preferential negotiating rights in areas where business risks are high or Japanese companies do not conduct exploration activities. By providing information obtained through the survey to Japanese companies, it reduces the exploration risk of Japanese enterprises, thus promoting participation in the acquisition of stakes in promising oil and gas fields and resource development projects. Able to obtain information directly from oil- producing countries and state-owned oil companies, JOGMEC surveys, analyzes, and provides specialized information, including market trends, geological information, resource potential, and details on legal and tax systems, to help Japanese companies secure positions that allow them to acquire such stakes.

In fact, when a project enters the exploration stage, JOGMEC provides funding support and grants integrated support in cooperation with other policy institutions in the development and production stage. Below, we take a

21 more detailed look at Japan’s support system.

Figure 2-1. Japan’s resource development support system

Source: 経済産業省 (2016a, p.12).

원문 번역문

자금지원 비자금지원

Financial support Non-financial support

해외 지질구조 조사 Overseas geological survey

국내 기초조사 Domestic basic survey

출자 사업·채무보증 사업 Equity investment/liability guarantees

해외 투자 보험·해외 사업자금 대출 보험 Overseas investment insurance/overseas operation loan insurance

자원 금융 Natural resource finance

해외투자 등 Reserve of overseas investment loss 제도(세제)

Reserve of overseas investment loss (tax system)

감모 공제 제도(세제) Percentage depletion (tax system)

사전 단계

탐사 단계

개발·생산 단계

Preliminary stage Exploration stage

Development/production stage

자원외교(장관 등의 고위급 방문, MOU,

해외인사 초청 등)

Resource diplomacy (through visit by high-level individual such as a minister, MOU, invitation of overseas personnel, etc.)

기술개발·기술활용(JOGMEC) (지질조사,

원유회수율 향상기술, 석유가스층 파악기술 등

지원)

Technology development/utilization (JOGMEC) (support for geological surveys, technology for improving crude recovery rate, and technology for detecting oil and gas deposits)

A. Financial support system

1) Japan Oil, Gas and Metals National Corporation (JOGMEC)

22 (1) Success Repayable Loan

With the establishment of the Japan National Oil Corporation (JNOC), support for the overseas exploration projects of Japanese companies was provided through loans, equity investment, and liability guarantees. JNOC also funded exploration projects through debt financing and equity investment, with the ceiling for the total support amount of debt financing and equity investment set at 70% of the total project cost. The loans provided by the JNOC were in the form of the Success Repayable Loan. If a company that had received the Success Repayable Loan failed to execute its project, it was liable for the repayment of a reduced principal amount. If the company succeeded, it would pay a special charge in addition to the principal and interest. When an exploration project was successful, the JNOC collected dividends from its contributed equity in addition to the principal and a special charge for the loan. However, as the support of the JNOC was provided on a project-by-project basis in accordance with its “One Project, One Company” method, the market was flooded with only small companies, making it difficult to foster large-scale resource exploration companies. Finally, due to the aforementioned moral hazard issue and difficulty fostering large-scale resource exploration, the Success Repayable Loan disappeared with the dismantling of the JNOC, and the remaining financial services that had been provided by the JNOC were transferred to JOGMEC. Currently, JOGMEC uses equity investment financing as its basic support tool, rather than the Success Repayable Loans.

Table 2-3. Changes in financing system for exploration projects JNOC

(1967~2004)

JOGMEC (2004~) Target Exploration projects of Japanese companies

Policy was abolished Scope

70% or less, including equity investment (80% was possible in exceptional cases)

Overseas: 70% / Domestic sea area: 70%

Type Success Repayable Loan

Loan conditio

n

Interest rate of 6.75% annually or more, with repayment period of 18 years

8 years of the unredeemed term (period during which the exploration project reaches the stage of continuous production)

Success Payment for 15 years

23 ful case

Unsucc essful case

Reduction of principal and interest

Ground s

Article 19 of the JNOC Business Procedure Manual:

clause calls for the reduction of loan principal and interest in the case of exploration project failure

Source: Korea Earth System Engineering Society (2009, p.8).

(2) Equity investment system

JOGMEC provides funds in the form of equity investment for high-risk petroleum and natural gas exploration projects and natural gas development, production, and liquefaction projects that require large amounts of funds.

In November 2016, the JOGMEC Law was amended to make it possible for JOGMEC to invest in the acquisition of oil and natural gas assets. The business areas eligible for JOGMEC’s equity investment are listed in the table below.

Table 2-4. Business areas eligible for JOGMEC’s equity investment and corresponding ratios Business area Equity investment ratio

Exploration and extraction of oil, etc.

Funds for the exploration, development, and production of oil and combustible natural gas (including oil sands and oil shale)

Funding ceiling is up to one- half of required funds.

In special cases, however, the ceiling can be three-fourths of the required funds.

Liquefaction of flammable natural gas Funds needed for the liquefaction of natural gas in overseas countries

The funding ceiling is up to one-half of the required funds.

Acquisition of rights to oil and others (asset acquisition business)

Funds needed for the acquisition of rights and implementation of oil extraction based on the acquired rights in the case of a Japanese company acquiring such rights or similar rights from an individual or company which has the right to extract oil

The funding ceiling is up to one-half of the required funds.

In special cases, however, the ceiling can be three-fourths of the required funds

24 and carries out such extraction

Acquisition of overseas oil company (company acquisition business)

Funds for the exploration and extraction of oil and liquefaction of flammable natural gas

Funds necessary for the acquisition of all or part of the shares of an overseas operating company or for an overseas operating company to do conduct its business

The funding ceiling is up to one-half of the required funds.

Source: http://www.jogmec.go.jp/oilgas/financial_002.html, visited on June 2017, summarized by the author.

Typically, the fund support ceiling is up to one-half of the required funds for operation. The ceiling had been up to 70% under the former JNOC, but it was lowered to 50% by JOGMEC. However, in 2007, JOGMEC raised its equity investment ceiling to 75% for petroleum exploration projects.12

Although JOGMEC’s equity investment can be as high as 75%, Japan still adheres to the principle of private sector leadership. For its equity investment, JOGMEC introduced class shares, which do not have voting rights, in order to prevent any threat to the principle of private sector leadership in cases where JOGMEC holds more stakes than the private sector. If the government contributes capital in excess of the shares of a private entity, the government’s stock equivalent to a private entity’s will be common stocks, and the rest will be class stocks with no voting rights and subject to repurchase, ensuring that the private entity can maintain its leadership in management. In consideration of their lack of voting rights, holders of class shares are paid higher dividends than for common stocks.

Table 2-5. JOGMEC’s Stake of Total Ownership for Private Sector Investment of 25% of Total Capital Private sector

ownership (common stock): 25%

JOGMEC’s contributed capital (common stock):

25%

JOGMEC’s contributed capital (class stocks, no

voting rights): 50%

⇒ Capital contribution ratio: 75%

Source: 石油天然ガス・金属鉱物資源機構 (2014, p.5).

Table 2-6. Changes in businesses eligible for capital contribution and the capital contribution ratio in japan

12

石油鉱業連盟 (2016, p.102).

25 JNOC

(1967-2004)

JOGMEC

2004- 2007- 2016-

Targ et busi ness

Exploration and development

Oil and natural gas exploration

Purchase of oil and gas fields

Development business and M&A were added (Nov.

2016)

Capi tal cont ribut ion ratio

70% or less, including loans

(in exceptional cases, 80% was possible)

50% or less (no exceptions)

In

exceptional cases of capital contributio

n and

liability guarantee, 75% was possible.

In the

development business and M&A, the highest ceiling is 50%.

Rem arks

- “One Project, One Company”

- The loss of a project company is not calculated as the profit or loss of an invested company.

- When JOGMEC provides a capital contribution of 50%

or more of the total shares,

JOGMEC’s stocks

equivalent to a private entity’s will be common stocks.

- The excess shares will be class stocks with no voting rights.

- The management rights of an invested private company are maintained under the principle of private sector leadership.

Source: Korea Earth System Engineering Society (2009, p.9), 石油鉱業連盟 (2017, p.94).

Figure 2-2. JOGMEC’s accumulated investment and number of sponsored companies

26

(units: JPY 100 million, no. of companies)

Source: JOGMEC Annual Report for each year

원문 번역문

출자액 누계 기업 수

Accumulated equity investment Number of sponsored companies

B. Investment guarantees

The purpose of the liability guarantee system is to ensure that third parties are able to pay their debts in the event debtors fail to fulfill their obligations to creditors. While exploration investment in oil development projects is difficult for the financial sector to provide through loans due to the high risk involved, development investment is relatively easier to secure due to its relative stability. Although the risk involved in the development stage may be less than the risk in the exploration project, the profits generated in the development stage could be lower than expected due to fluctuations in the production reserves caused by technological factors, fluctuations in oil prices and exchange rates due to economic factors, and sudden disruptions in oil-producing countries caused by political factors. In addition, Japanese financial institutions generally do not accept foreign assets as collateral for loans.

Therefore, regarding overseas oil field development projects, which require large amounts of capital, there are cases where investors or third parties must guarantee liability in order for a project company to borrow the funds it requires for development from financial institutions. To facilitate investment in these oil development projects, the JNOC provided a liability guarantee for oil development companies borrowing oil development funds from financial institutions. The JNOC’s liability guarantee system secured 60% of the total loan amount for development-stage projects from the Japan Bank for International Cooperation and Japanese financial institutions.

The JNOC provided debt guarantees mainly for the financing of development projects but also provided companies (producing crude oil and able to repay their debts) with liability guarantees for the financing of

27 exploration projects.

Table 2-7. Changes in the liability guarantee system JNOC

(1967-2004)

JOGMEC

2004- 2007-

Target Funds for

development Funds for development Covera

ge 60% or less 50% or less (2004-

2007) Increased up to 75%

Financi al instituti

ons

Export-Import Bank of Japan (~1999) and private financial institutions

Japan International Cooperation Bank (1999~) and private financial institutions

Source: Korea Earth System Engineering Society (2009, p.11).

Since 2004, when JOGMEC changed its liability guarantee system into a system that supports resource development, the liability guarantee system has persisted, and JOGMEC’s debt guarantees are limited to overseas activities. JOGMEC provides liability guarantees for debt financing required by companies for the overseas exploration and development of oil, production (including refinement), and liquefaction of natural gas. The business areas eligible for liability guarantees are the same as those for JOGMEC’s capital contribution.

Figure 2-3. JOGMEC’s liability guarantee amount and number of sponsored companies

(Units: JPY 100 million, no. of companies)

Source: JOGMEC Annual Report for each year.

원문 번역문

28 채무보증액

기업 수

Liability guarantee amount Number of sponsored companies

C. Policy finance provided by other supporting organizations 1) Japan Bank for International Cooperation (JBIC)

The Japan Bank for International Cooperation (JBIC), which is responsible for lending funds to companies involved in overseas resource development projects, was established in 1999 by integrating the former Export- Import Bank of Japan (EIBJ) and former Overseas Economic Cooperation Fund (OECF).13

In October 2008, the JBIC was integrated with the National Life Finance Corporation, the Agriculture, Forestry and Fisheries Finance Corporation, and the Japan Finance Corporation for Small and Medium Enterprises, establishing the Japan Finance Corporation (JFC). Although the JBIC continued to fulfill its role, under the same name, as the International Division of the JFC,14 its missions related to overseas economic cooperation were transferred to the JICA. The JBIC provided public support for the overseas resource development projects of Japanese companies, in consideration of the difficulty for resource development companies to hit their stride due to the risks of resource reserve and price fluctuations in the resource development business.15 In accordance with the JBIC Law, promulgated in May 2011, the JBIC became a separate entity in April 2012 and has existed as the current JBIC ever since.16

The JBIC invests a certain percentage of the required funds in development companies whose overseas projects have progressed to the production stage or beyond. It actively provides import or investment financing to companies that contribute directly or indirectly to securing Japanese resources in the future, such as through the long-term, contract-based import of resources, development of resources after the acquisition of project participation rights, strengthening of the competitiveness of Japanese resource development companies, and infrastructure improvement necessary to secure resources.

The Development Bank of Japan (DBJ), another provider of policy financing for oil and natural gas development projects conducted on Japan’s continental shelf, also provides interest payment guarantees to oil and

13 国際協力銀行 (2017, p.2).

14 Ibid.

15 JOGMEC provides equity capital to oil and natural gas companies conducting development projects around the continental shelf of Japan.

16 国際協力銀行 (2017, p.2).

29 natural gas development companies.17

Table 2-8. Development loan amounts provided by the JBIC for oil exploration and development projects

Year Loan amount

(JPY 100 million)

Change (year-on-year, %)

2009 4,033 -39.1

2010 2709 -32.8

2011 3,673 35.6

2012 12,645 244.3

2013 3,372 -73.3

2014 9,927 194.4

2015 4,865 -51.0

Note: JBIC’s loan amount is for companies’ contributions to the long-term stability of the supply of energy and mineral resources (including oil and natural gas).

Source:石油鉱業連盟 (2015 p.15, 2016 p.16, and 2017 p.33).

2) Nippon Export and Investment Insurance (日本貿易保険, NEXI)

Nippon Export and Investment Insurance (NEXI) provides guarantees against a wide range of risks arising from export and foreign investment with the aim of protecting Japanese companies from foreign trade risks that cannot be covered by private insurances. As NEXI’s most representative product, the Comprehensive Resource and Energy Insurance provides Japanese businesses with investment and loan guarantees for their acquisition of rights and transactions. For the purpose of “expanding high-quality infrastructure partnerships” in May 2015 and maintaining “quality infrastructure partnerships” in 2016, NEXI prepared an insurance product that covers 100%

of the political risk arising from investment and loans.18

On April 1, 2017, NEXI was converted from an independent administrative agency into a special company under the full ownership of the government.19 The purpose of this transition was to reflect the government’s policy goals by strengthening unity with the government and improve management freedom, efficiency, and agility. In addition, as the Japanese government abolished the special account in trade reinsurance, the assets and

17 日本政策投資銀行 (2016, p.45).

18 日本貿易保険 (2015, pp.3~5), 日本貿易保険 (2016, p.3).

19 日本貿易保険 (2016, p.7).

30

liabilities of the special account were moved to NEXI. However, the government revised a rule to enable it to take necessary financial measures, under the Trade Insurance Act, in the event NEXI faces financing difficulties, in order to perfectly guarantee payments for insurance claims in cases of emergency.

Table 2-9. Type of insurances and businesses eligible for coverage provided by nippon export and investment insurance

Insurance

type Coverage

Overseas investment

insurance

- If a Japanese company establishes a joint venture with an overseas subsidiary, or if a sub-subsidiary of a Japanese company engages in overseas business activities, this insurance compensates for losses caused by the discontinuance of business activities due to war, terrorism, or natural disaster.

Overseas business loan

insurance

- For Japanese companies, banks, etc. financing business projects of foreign governments and providing debt guarantees for resource development projects that can help

countries with economic development, this insurance compensates for risks that can arise in guaranteeing debt or

providing loans. The insurance compensates for losses incurred in the event such foreign governments or companies go bankrupt (lack of ability to redeem debt) or

become insolvent due to force majeure (war, natural disaster, etc.).

Comprehensi ve resource and energy insurance

- To fundamentally strengthen the capability to secure a stable supply of resources from overseas, this insurance covers a wide range of risks at lower premiums than existing insurance products, given the nature of safety risks in the resource and energy development business. The comprehensive resource and energy insurance gives the option of a special agreement, such as an insurance covering overseas business loans.

- This insurance covers the losses of Japanese companies or banks that provide business loans to foreign governments and companies for overseas projects. It can compensate for:

① losses arising from a force majeure (such as war,

31

revolution, or prohibition of foreign exchange and foreign currency transfers) or ② losses arising from the delayed payment of a loan or failure of debt redemption caused by bankruptcy or default.

Source: 日本貿易保険 (2016, pp.19-21), summarized by the author.

D. Tax support system

1) Reserve of overseas investment loss

Due to the nature of the resource development business, such as the high risk of failure and vulnerability to national risks, overseas resource development projects may incur large losses. In Japan, overseas resource development companies can accumulate a reserve in order to prepare for such losses and corporate risk (such as a decrease in the value of acquired shares and bad debt loss20). It is a reserve system that allows companies to include a reserved amount in their deductible expenses. In Japan, when a domestic company (investor) that has submitted a Blue Declaration21 acquires the stocks and bonds of a resource development company that meets certain requirements, it shall accumulate an amount equal to or less than a certain percentage of the acquisition price as reserve funds, which will be included as a loss amount for the current year.22 The types of resources covered by this system are: petroleum, combustible natural gas, metallic minerals, coal, and wood (development only).

In 1973, Japan introduced the Reserve of Overseas Investment Loss System,23 in accordance with Article 55 of the Special Taxation Measures Act, Article 32-2 of the Enforcement Decree of the Special Taxation Measures Act, and Article 21 of the Enforcement Regulations of the same Act. The system’s special tax treatment is a sunset clause that is effective during a limited period of time and can be extended when necessary. The Ministry of

20

貸倒損失(bad debt loss): loss due to non-recoverable debt (bad debt).

21 A document that declares a clear and fair income, income tax, corporation tax, etc, calculated based on a bookkeeping method that is in compliance with related laws, such as double-entry bookkeeping.

22 oilgas-info.jogmec.go.jp, 石油天然

ガス

用語辞典, 海外投資等損失準備金制度, visited on May 24, 2017.23 経済産業省(2016d, p.69).

32

Economy, Trade and Industry has been extending the clause at each deadline. The most recent extension of the sunset clause, until March 31, 2018, was possible due to the “Request for 2016 Local Tax Revision.”

The reserve amounts accumulated for resource development projects differ depending on the stage of the project. In the exploration24 and development stages, 70% and 30% of the total investment amount are deposited as a loss reserve over a period of five years. If the project proceeds without any loss, the reserve will be included in the net income for the following five years (one-fifth will be included in each of the five years).25

Companies gain two benefits by allowing investors in exploration and development projects to include an accumulated loss reserve amount for covering investment losses. One is a reduction of the impact of loss risk on companies, and the other is the improvement of cash flow. If a project fails, the accumulated loss reserve can be included in the gains, thus reducing the losses incurred through an accounting technique. Therefore, this system can offset the financial risks of investment in exploration and development and has the effect of a deferred tax payment if the project succeeds, thus enabling the company to manage its funds at an interest rate of zero. Cash flow can also be improved by securing the liquidity of operating funds. Under this system, Japanese companies’

investment in exploration and development has been promoted, resulting in an improvement in Japan’s self- development ratio and contributing to the achievement of the policy goal of securing a stable supply of energy and mineral resources for the country.26

According to the “Request of 2016 Local Tax Revision” in 2016, which contributed to the extension of the reserve of overseas resource development loss in Japan, Japan’s self-development ratio for petroleum and natural gas was 24.7%, as of 2014. Projects that reached the commercial production stage using the reserve of overseas resource development loss accounted for 60% of all self-development projects, thereby proving that the reserve system contributed to maintaining and improving the self-development ratio. In the case of non-ferrous metals, projects using the reserve system accounted for more than 80% of all self-development projects. The reserve system has proven to be quite effective in increasing the self-development ratio, which has risen from 53% in 2010 to 59% in 2013.27

2) Depletion deduction system

Depletion refers to the reduction in value of natural resource reserves (such as petroleum, coal, and minerals)

24 100% of the investment amount until 2009, 90% until 2015,

25 経済産業省(2016e, pp.26~27)

26 経済産業省(2016d, p.69)

27 経済産業省(2016d, p.73).

33

through production. In order to sustain their businesses, petroleum development companies need to secure a petroleum reserve equal in size to the amount they have actually produced. The value of resource development companies in general can be sustained only if they secure resource reserves equal in size to the amounts by which the resources have been depleted, which can be done by purchasing mines or conducting exploration projects.

The Japanese depletion deduction deducts a percentage of the gross sales or net profit to secure exploration funds for acquiring new resource reserves to compensate for the depleted resources. In general, the depletion deduction is a concept that corresponds to the depreciation of tangible assets, which is also analogous to the concept of including reserve assets of a decreased value (due to the production of natural resources) in the losses.

In the case of Japan, however, the depletion deduction is used to support exploration projects by compensating for decreases in the value of reserve assets caused by production. New mines are usually located in places where the development environment is relatively poor compared to those of existing mines, thus requiring higher exploration costs and involving greater risk. The Japanese depletion deduction also includes the concept of deducting a provision (or reserve) amount from taxable income for high-risk exploration activities.

In Japan, the depletion deduction system includes the exploration provision system and the special deduction for new mine exploration expenditure (depletion deduction and overseas depletion deduction). Funds required for new exploration are deposited as reserves, and when the funds are actually spent to cover exploration expenses, they can be deducted from the net income. In this way, an incentive is provided that enables oil and gas companies to continue carrying out new exploration activities.

Table 2-10. Japan’s tax benefits for oil and natural gas development

Category Description Deduction Rate

Reserve of overseas investment

loss

If a domestic investor acquires specific stocks of a resource development company that meets certain requirements and then accumulates a certain percentage of an amount equal to or less than the acquisition value as a reserve, according to a particular type of share, the reserved amount will be included in the losses for the current business year.

If the investment project fails, the reserved amount is added to the profit of

Exploration: 70%

Development:

30%

34

the withdrawal, which is offset by the loss of the investment project, thus contributing to the leveling of closing accounts.

If the investment project proceeds smoothly, an equal amount of this reserve is divided evenly and included in the profits for the next five years, after a five-year grace period.

Depletion deduction system (provision

for exploration)

To compensate for the decrease in the reserved amount of natural resources due to production, funds for exploring new mines are deposited as a provision (or reserve). Part of the provision (or reserve) amount that meets certain criteria is deducted from taxable income.

This tax benefit in the mining industry is a special treatment in taxation that allows a tax payer to deduct exploration expenses from revenue if an accumulated reserve amount is spent as exploration expenditure within five years.

12% of sales or 50% of net

income

Source:経済産業省 (2016e, pp.26~27), summarized by the author.

35

Chapter 3. Domestic Resource Development Support System

Similar to the overseas system, the domestic resource development support system can be divided into financial support and tax support. Financial support is provided through means such as loans, insurance products, and guarantees, while tax support is provided by specifying items, such as the acquisition of mining rights and special treatment in taxation, for facility investment. This chapter explores the features of each type of support.

A. General loan and Special Loan systems

A typical financial support system for overseas resource development is a loan system. It is difficult for SMEs to engage in resource development activities independently due to the high initial investment costs involved.

Moreover, it is also difficult to induce the participation of large, well-established corporations, which operate low- risk businesses, due to the high-risk and high-return characteristics of the resource development business. In December 1983, the government formed a financing support system through the establishment and announcement of the former Ministry of Power and Energy’s Notification No. 83-31 (Loan standards for funds required for oil development projects). The purpose of this financing support system, which used funds from the Special Account (Special Energy Account) for Energy and Support Projects, was to lower the entry barrier and mitigate the risks involved. Businesses in the development and production phases are eligible for the general loan, while overseas exploration companies exposed to high levels of risk are eligible for the Special Loan and investment risk guarantee.28 The Special Loan adopted a risk-sharing system through which unsuccessful exploration projects are provided with exemptions or reductions of their loan principal, and successful exploration projects are required to pay a special charge, thereby mitigating the risks to which such projects are exposed. The Success Repayable Loan System, which had been operated along with the general loan since 1983, was reformed to create the Special Loan by adjusting the loan amount and exemption and reduction rates and revising the related enforcement regulations in January 2017.

The last application submitted to the general loan system, which has been in operation since 1983, was for a loan for the Yemen LNG gas field project in 2007. While general loans were actively used for the development and production stages of projects until 2004, increasingly larger amounts of Success Repayable Loans began to be provided from 2004, far surpassing the general loan amount, as the number of exploration projects increased.

28 The Korea National Oil Corporation is a leading company for resource development on Korea’s continental shelf. In addition, the investment risk guarantee provided by the Korea Trade Insurance Corporation, which offers insurance products for overseas resource development funds, is also subject to the Special Loan.